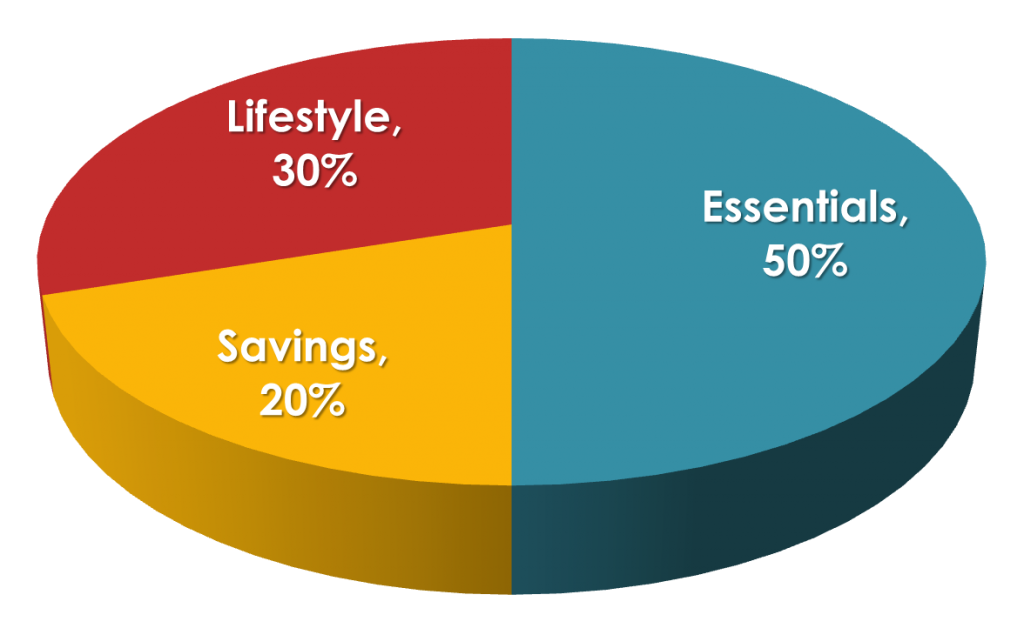

Your income goes to needs, 30% to wants and 20% to savings.

50 30 20 budget how to#

Make sure to read to the bottom of the article to download the free 50 30 20 rule spreadsheet! Here’s how to use the 50 30 20 budgeting rule How this budgeting strategy started: Senator Elizabeth Warren founded the rule in her book, “ All Your Worth: The Ultimate Lifetime Money Plan.” (Buy it here on Amazon.) It’s a strategy designed to balance your needs and wants, while making sure you’re saving for a solid financial future.īasically, the 50 30 20 budgeting rule is the foundation for getting your financial life in order. I’ll break it down for you here and provide a 50 30 20 rule and spreadsheet. It’s perfect if you’re looking for an easy budget strategy or new to budgeting. Contact P&N for a financial health check today.The 50-30-20 budgeting rule is a simple plan to manage your money. So keep learning and adapting and you’ll see financial success in no time. Remember, as your financial position changes, so should your budgeting.

50 30 20 budget professional#

Once you’re in a routine and looking to broaden your goals such as building wealth or investing, it may help to seek professional advice on your financial situation to achieve your financial goals and objectives with a budget sheet. Moving forwardĪ simple look at budgeting like the 50/30/20 rule is a great place to start effectively managing your money. This is about understanding the balance, and introducing some budget planning into your banking routine. You may need to pinch the percentages for wants or savings to enable a good lifestyle. Low to middle income earnersįor those who live in expensive areas, or with slightly lower incomes, it may prove difficult to only spend 50% of your salary on rent and outgoings. So tweaking the savings percentage could enable you to live comfortably, and reach savings goals even sooner. High income earnersįor those with high incomes, a 50% and 30% allocation towards need and wants may be too high, encouraging some extra spending. However, there may be some occasions where you can adjust the percentages to fit your circumstances.

:strip_icc()/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

So you can see how much is allocated to each category, and how savings can grow over a year. four weeks x 12 months), the monthly expenditure has been calculated by multiplying the weekly expenditure by 4.334 (52 weeks / 12 months). Please note: As there are 52 weeks in a year, not 48 (i.e. with the 50/30/20 budget calculator: The 50/30/20 budget calculator Scenario 1 - annual income $52,000Įxpenditure (rounded to the nearest dollar) To show you how it works, let’s use two individuals, one receiving an after-tax income of $52,000 p.a. and the other receiving an after-tax income of $104,000 p.a.

saving for a new car or a housing deposit), additional debt repayments, as well as investments inside and/or outside of superannuation. 20% on savings, such as emergency funds, savings accounts (e.g.30% on wants, such as daily coffee, eating out, shopping, entertainment, hobbies, and holidays, etc.

0 kommentar(er)

0 kommentar(er)